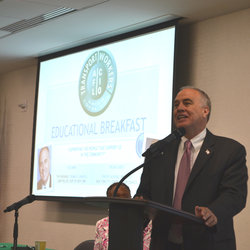

At TWU Breakfast, State Comptroller DiNapoli Renews Commitment to Working People

DiNapoli said his office strives to fulfill a "double bottom line," which is to "do well for the fund, and to do well for the community." This means that he seeks the best return possible for retirees, while also trying to invest in ways that return a benefit to local communities. He showcased his office's commitment to engaging minority and women-owned investment firms to compete with the large "too big to fail" investment houses in managing public funds. He also spoke at some length about his commitment to environmentally beneficial investing, including sitting on the board of the Ceres coalition of socially responsible investors.He said that he was engaged with fossil fuel companies to make sure that they include the costs of global warming as part of their investment outlook. The New York State Common Fund, which DiNapoli manages, is now at its highest level ever, with $176 billion under management.

TWU Local 100 Secretary-Treasurer Earl Phillips praised DiNapoli's steadfast defense of defined benefit pensions. DiNapoli in turn commended TWU Local 100 President John Samuelsen. "John Samuelsen is the real deal in a labor leader," he said. "He came through a tough negotiating process beautifully."

DiNapoli gave a wider perspective on financial management when he spoke of a worldwide crisis in which three billion people live on less than $1 a day, and where "the five Wal-Mart heirs have as much income as 40% of all Americans." He said that people must "recognize that our economy didn't just happen. We've seen a systematic breakdown of the social safety net. We've seen a diminishment of rights and economic power for workers which is inextricable from attacks on collective bargaining."